Self-service retail faces challenges in going cashless

Managing retail locations in multiple countries in Europe obviously has its challenges. When it comes to self-service machines like coffee, snacks, and fresh food vending machines, there are still many cash-only machines out there. Making the transition to contactless payments is often a challenge due to a multi-vendor policy, dated tech, and complex integrations with, e.g., inventory management, point-of-sale, and ERP software.

Transitioning towards cashless or offering multiple payment options for all countries can be a huge project. Is it worth undertaking? Keep reading to learn the latest research on payment preferences for countries in the EU.

The decline of cash and the urgency to offer contactless payments

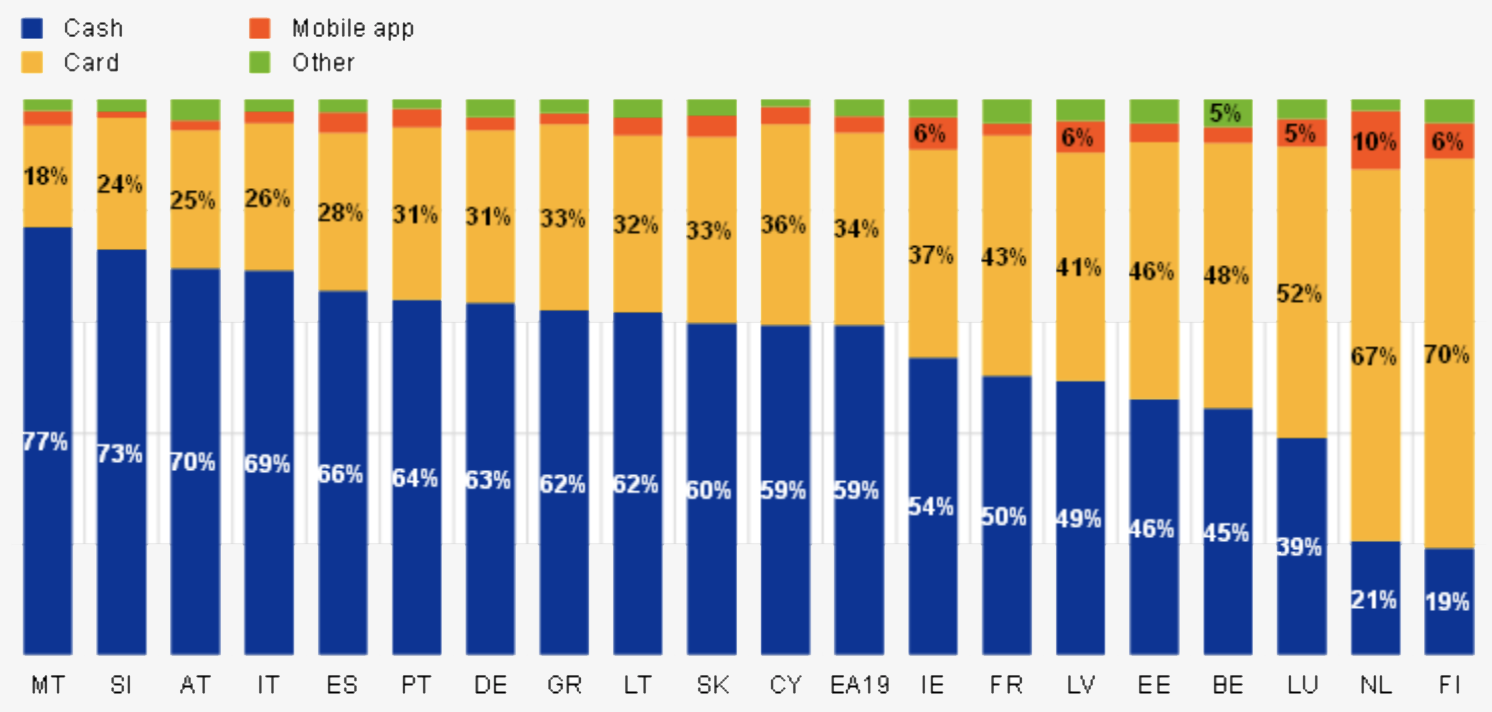

Let’s start with the multi-year survey by the European Central Bank (ECB) on payment trends. In short, the use of cash is declining rapidly. In this study named SPACE shares a similar conclusion: 55% of euro area consumers expressed a preference for cards and other cashless payments when paying in a shop, while 22% preferred cash and 23% had no clear preference.

Cash use declined most in southern European countries, such as Greece, Spain, Cyprus, and Portugal. This was observed across most Euro area countries, although the share of cash payments is virtually unchanged in both Slovenia and Estonia.

The reason for this decline? It comes as no surprise that the pandemic has sped up the use of cashless options. A 2022 empirical study investigated how the COVID-19 pandemic has changed how people make payments. It’s based on a survey of over 5.000 respondents from 22 European countries.

In short, the research concludes:

- During the COVID-19 pandemic, payment behaviour shifted toward cashless payments.

- The scale of change in payment patterns varies highly between European countries.

- Heavy cash users were generally less likely to adopt cashless solutions.

- The divide between cash and cashless users seems to have widened during the pandemic.

Basically, consumers who had been making cashless payments prior to the outbreak of the pandemic have been more likely to do so. On the other hand, the consumers who had mostly been paying in cash have often continued to do so. Interestingly, the study states that the probability of more frequent cashless payments is as much a result of the pandemic as country-specific factors.

Countries depending on cash vs cashless

But there are big differences between countries in payment preferences. Merchant Machine has compiled a list of the top ten countries globally, including the EU, that rely on cash the most. Romania tops the list, followed by Egypt, Kazakhstan, Bulgaria, Ukraine, Morocco, Philippines, Peru, Hungary, and Vietnam. The article mentioned these key reasons: a limited number of people without a bank account, limited access to the Internet and a high average of available ATMs per 100,000 inhabitants. One example: in Romania, only 42% of the people have a bank account compared to 100% in Norway.

On the other side of the spectrum, there are countries well on their path to going cashless. Multiple 2023 publications list countries like Sweden, Norway, the Netherlands, Finland, and the UK that use the least cash. The research cites reasons like the legality of sellers refusing cash and the scarcity of ATMs. It’s no surprise that Norway is leading the pack. No less than 3 out of 4 transactions are settled cashless.

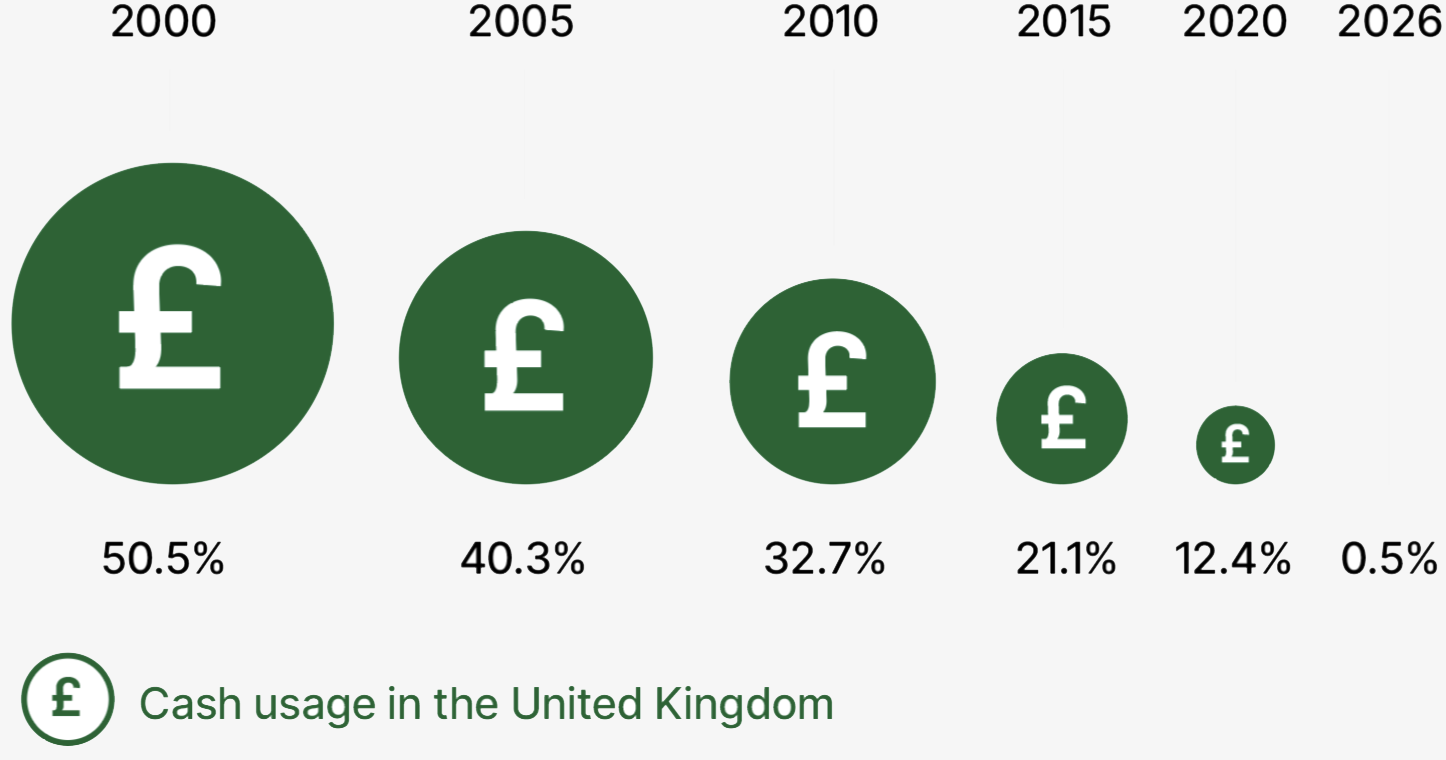

The first country to go cashless

Some have predicted countries to go completely cashless. The UK is one of them. The country has seen a sharp decline in the usage of cash over the last few years. If they continue on the current downhill slope, predictions are that cash usage in the UK could reach 0% by as soon as 2026.

Finland is another example. The government-owned Bank of Finland has predicted that the country will be completely cashless by 2029. Research by Merchant Machine mentions high trust in government and banks as a key driver for adopting digital payment systems.

Atze Faas on countries going cashless

“I understand the buzz around going cashless. The signs are clear; most EU countries are witnessing a decline in cash usage. Moreover, the benefits are abundant for both retail businesses and countries, even from a European perspective. The advantages for both countries and companies are strikingly similar: combating fraud and money laundering benefits both nations and individual stores. Additionally, the risks associated with transporting cash make it an unsafe and unsustainable option for both companies and countries.

For instance, did you know that cash is centralised in just one location in Finland, Helsinki, where it’s collected, counted, and then distributed back into the country? It’s quite a logistical challenge. Undoubtedly, going cashless has its perks. Personally, I believe companies and the EU should embrace this shift. However, two significant movements make me sceptical about the immediate future of cashless transactions.

Firstly, the EU recognizes the benefits of cashless, yet there are conflicting laws, with new laws in the pipeline. Since there seems to be a cultural divide between Northern and Southern Europe in payment preferences, some countries request laws to defend their use of cash. With a new law (Regulation on the legal tender of euro banknotes and coins) in the making, it looks like this will become a reality under EU approval. One of the things this law grants is to give countries the authority to require shops to accept cash if they perceive that the cashless trend is harming their economy.

Secondly, there’s been a slight increase in cash usage post-COVID, as observed in countries like Denmark. This affects policymakers and will likely slow down the move towards going completely cashless for the time being. Also because cash offers resilience in case of internet or power outages.

These two trends lead me to believe that a completely cashless future isn’t imminent. There will likely always be a percentage of transactions conducted in cash. Cash will continue to hold its place in the payment mix. In the years to come, I expect the decline to hold at around 10%.”

About Atze Faas

Add cashless payment options to your self-service machines with SmartNow

We upgrade your existing machines with contactless payments and connectivity. For companies like IKEA, Circle K and Avolta, we take their machines into the digital age with added connectivity, new payment options, one unified dashboard and advanced integrations.

During a 20-minute demo call, we’ll explore digitisation use cases tailored to your company’s specific needs. Schedule your call today and learn more about the power of smart self-service machines.